Financial guidance to help you live your best life

Our Mission is Simple.

We meet business owners, their employees and families where they are and help them live their best lives through developing a clear path towards their financial future- despite the obstacles that may lie ahead.

We all have big dreams.

WayPath Financial is here to help make them a reality.

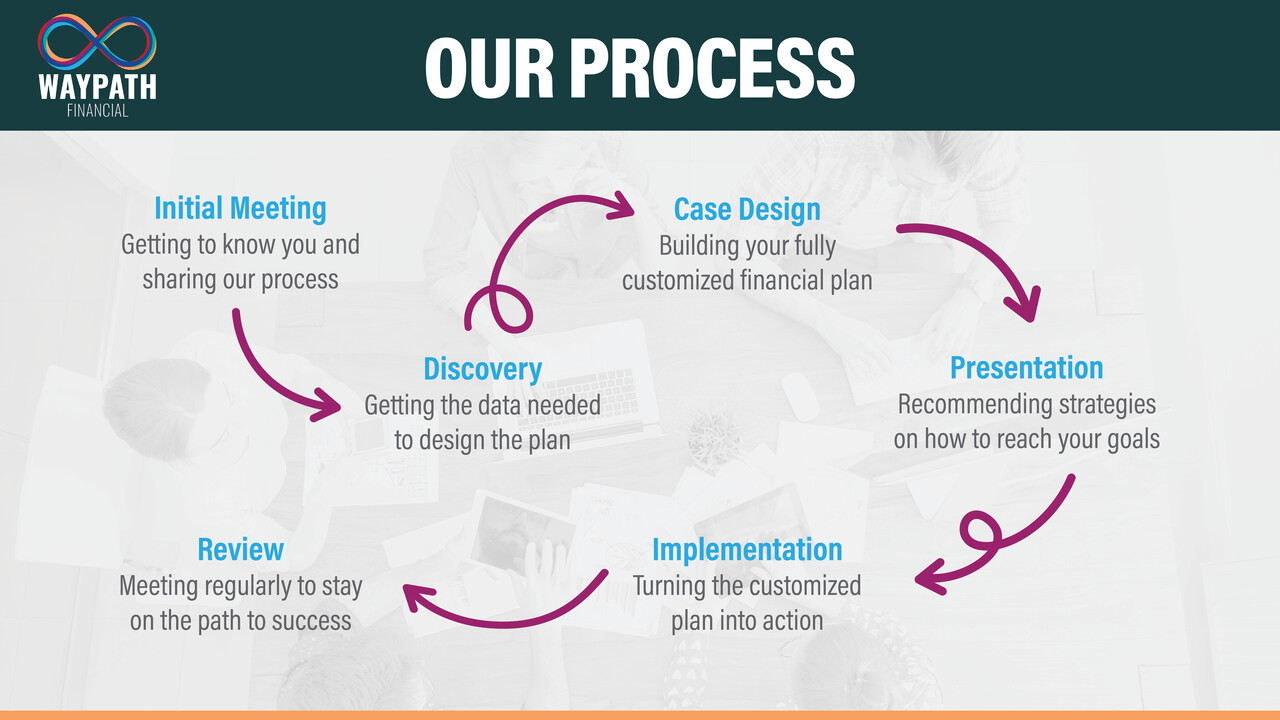

We aren’t just a team of financial advisors trying to fit you into a pre-determined solution. We are here to listen to all of your hopes and dreams, get a complete understanding of where you are on the path to success, and create a customized, comprehensive plan to help your reach your financial goals.

When you become a client, you become family.

What We Offer

Business Planning

You know what it takes to build a successful business. It takes vision, preparedness, skills and desire – not to mention a focused dedication to achieving your goals. If you are like most business owners, you’ve worked hard and made many sacrifices to grow your business. That’s why you should put just as much energy into protecting it as you did building it

Businesses

Brent is a Certified Business Valuation Specialist ™. Waypath offers complimentary software that can provide you a 97% accurate estimate in less than 30 minutes. With this information you can make critical decisions on what, when, and how to maximize your largest asset.

Ask yourself these important questions:

- Do I have a plan for my business when I retire?

- Is my business capable of continuing its success in the event of my or my partner’s untimely death or disability?

- Is my family adequately protected if something were to happen to me?

- Have I done everything I can to attract, retain and reward the key employees that are critical to my business?

If you answered “no” to any of these questions, you may want to consider implementing a formal business planning strategy. Proper planning can help you protect your business, attract and retain key employees, and help ensure that your business transfers in the manner in which you choose.

No business plan is complete without a financial strategy for the unexpected. Start by exploring all your protection options. Then develop a long-term strategy that can help protect the continuity of your business should you, a partner, or key employee decide to retire, leave the business, or unexpectedly dies or becomes disabled.

Most business owners spend the majority of their time working in their business instead of on their business. We can help ensure that the business protection needs that are critical to the long-term success of your business are taken care of.

Succession Planning*

The death or disability of an owner is one of the greatest threats to a business. Not only can it severely impact the day-to-day operation of the business, but it can raise all sorts of business succession and estate tax problems – proper succession planning can help.

Succession planning affects everyone who has an interest in the business—business partners, family members, and key employees. It is critical that you have meaningful discussions about often overlooked issues, such as who the ideal successor should be, what is the value of the business, and what is the timetable for transition. No matter what event occurs, either expected or unexpected, we can help you develop a succession plan that can help ensure a smooth transition according to your vision for the business’ future.

Consider a few of the following options:

Disability Income Insurance

A disability Buy-Sell policy is a great way to help ensure the orderly succession of a multi-owner business in the event of a long-term disability.

Life Insurance

Business succession plans* using life insurance can help ensure that your business is protected.

*Neither Brent Gordon nor Waypath Financial provide qualified business valuations. For a qualified or certified business valuation, consult a properly credentialed appraiser.

Financial Planning

Brent Gordon is a CERTIFIED FINANCIAL PLANNER™ professional with a commitment to the clients that WayPath serves.

We can’t predict the future, but we can plan for it!

See how we can plan to get you from here to there

Click here to watch a video on how easy it is to keep track of your financial plan

Investments

To consistently track that your investments match your risk tolerance, WayPath offers complimentary software.

Protection Planning

Many people overlook the fact that their largest assets are themselves and their loved ones. If the plan is the bridge, the protection plan is the guard rails, allowing you to get where you want to go, worry-free.

What would you do if:

- you couldn’t work?

- You had to have constant care for the last years of your life?

What would your loved ones do?

Would they be able to:

- maintain your current lifestyle

- raise your kids the way you would

- step in and run your business

- care for you 24 hours a day while trying to live their life

You are the asset, and the (life / disability / long term care) insurance ensured that your best life can be lived today, tomorrow, and in the future.

With products constantly changing in the marketplace, rest assured that WayPath will do the due diligence to give you the right recommendations to add to your financial tool belt.

Don’t just check the “I have some of that” box, allow us to do that with you.